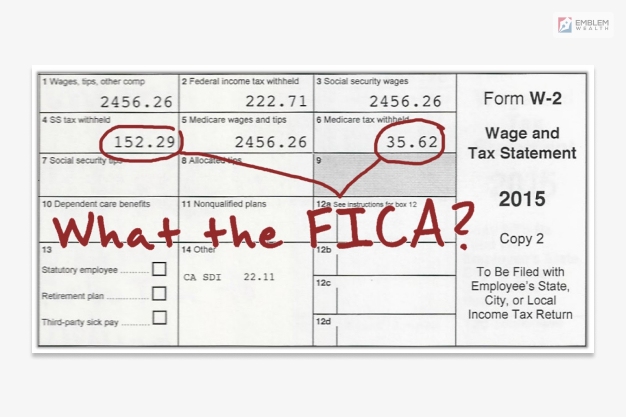

FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Last updated 17 novembro 2024

Both employees and employers are required to pay FICA tax, which is withheld from an employee

Withholding Social Security Tax from Wages—Things to Consider

13 States That Tax Social Security Benefits

Social Security wage base is $160,200 in 2023, meaning more FICA taxes for higher earners - Don't Mess With Taxes

What are the major federal payroll taxes, and how much money do they raise?

SOCIAL SECURITY TAX AND THE MAXIMUM TAXABLE INCOME LIMIT

How To Calculate Payroll Taxes? FUTA, SUI and more

Income Taxes: What You Need to Know - The New York Times

Understanding Your Paycheck

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

What Is FICA On My Paycheck? What Is FICA Tax?

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog17 novembro 2024

-

What is FICA tax?17 novembro 2024

What is FICA tax?17 novembro 2024 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest17 novembro 2024

Important 2020 Federal Tax Deadlines for Small Businesses - Workest17 novembro 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)17 novembro 2024

2023 FICA Tax Limits and Rates (How it Affects You)17 novembro 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand17 novembro 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand17 novembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know17 novembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know17 novembro 2024 -

What Is FICA Tax? —17 novembro 2024

What Is FICA Tax? —17 novembro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and17 novembro 2024

-

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example17 novembro 2024

What Is Social Security Tax? Definition, Exemptions, and Example17 novembro 2024 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons17 novembro 2024

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons17 novembro 2024

você pode gostar

-

How to Use Roblox Mobile Avatar Editor on PC17 novembro 2024

How to Use Roblox Mobile Avatar Editor on PC17 novembro 2024 -

The best Call of Duty Vanguard Zombies covenants17 novembro 2024

The best Call of Duty Vanguard Zombies covenants17 novembro 2024 -

RESULTADO DO JOGO DE PORTUGAL HOJE (10): Portugal eliminado? Veja o placar de Marrocos x Portugal na Copa do Mundo 202217 novembro 2024

RESULTADO DO JOGO DE PORTUGAL HOJE (10): Portugal eliminado? Veja o placar de Marrocos x Portugal na Copa do Mundo 202217 novembro 2024 -

TOASTERS 'N' MOOSE LIVE at 12pm PDT on Friday, 10/6 and Friday, 10/13.17 novembro 2024

-

Kiyotaka Ayanokoji Personality Classroom Of The Elite - Anime Personalities17 novembro 2024

Kiyotaka Ayanokoji Personality Classroom Of The Elite - Anime Personalities17 novembro 2024 -

Pulseira Pingente Elemento Personagem Electro Genshin Impact17 novembro 2024

Pulseira Pingente Elemento Personagem Electro Genshin Impact17 novembro 2024 -

FIERGS, SESI, SENAI e IEL estarão na Gramado Summit 2023 // Start17 novembro 2024

FIERGS, SESI, SENAI e IEL estarão na Gramado Summit 2023 // Start17 novembro 2024 -

Códigos Free Fire de 27 de outubro: todos os códigos para obter17 novembro 2024

Códigos Free Fire de 27 de outubro: todos os códigos para obter17 novembro 2024 -

All Star Tower Defense Original Soundtrack: Main Theme - song and lyrics by Albert Kim17 novembro 2024

-

ícone de símbolo de sinal de logotipo de trilha de trilha de17 novembro 2024

ícone de símbolo de sinal de logotipo de trilha de trilha de17 novembro 2024