Cash App Taxes 2023 (Tax Year 2022) Review

Por um escritor misterioso

Last updated 15 novembro 2024

Cash App Taxes supports most IRS forms and schedules for federal and state returns, including Schedule C. It's the only service we've tested that doesn't cost a dime for preparation and filing, but it doesn't offer as much support as paid apps.

Free, comprehensive federal and state tax filing

Free, comprehensive federal and state tax filing

Cash App Tax review 2023

can you file taxes on cash app 2023|TikTok Search

Cash App Taxes 2022 Review (Formerly Credit Karma Tax)

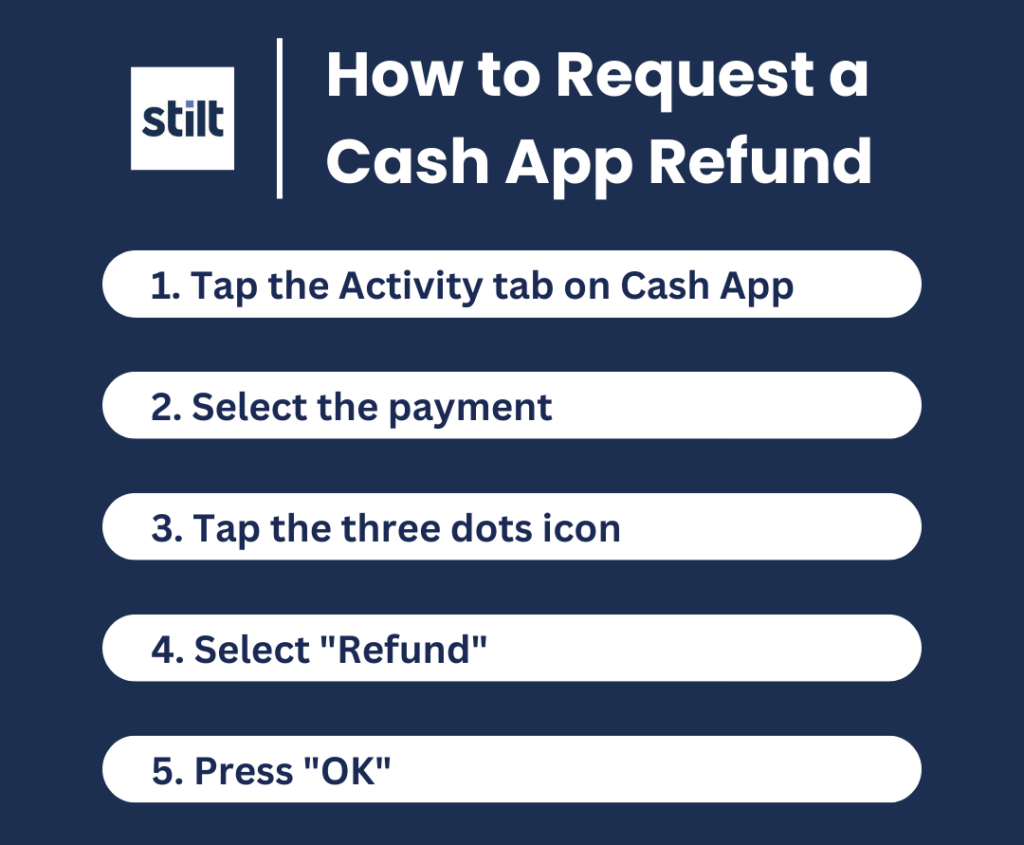

THIS is how to easily get a Cash App refund [2023]

Cash App Income is Taxable; IRS Changes Rules in 2022

Cash App Taxes Review 2023 Pros and Cons + How To Get Your Tax Refund Faster

Venmo, CashApp and other payment apps face new tax reporting rule

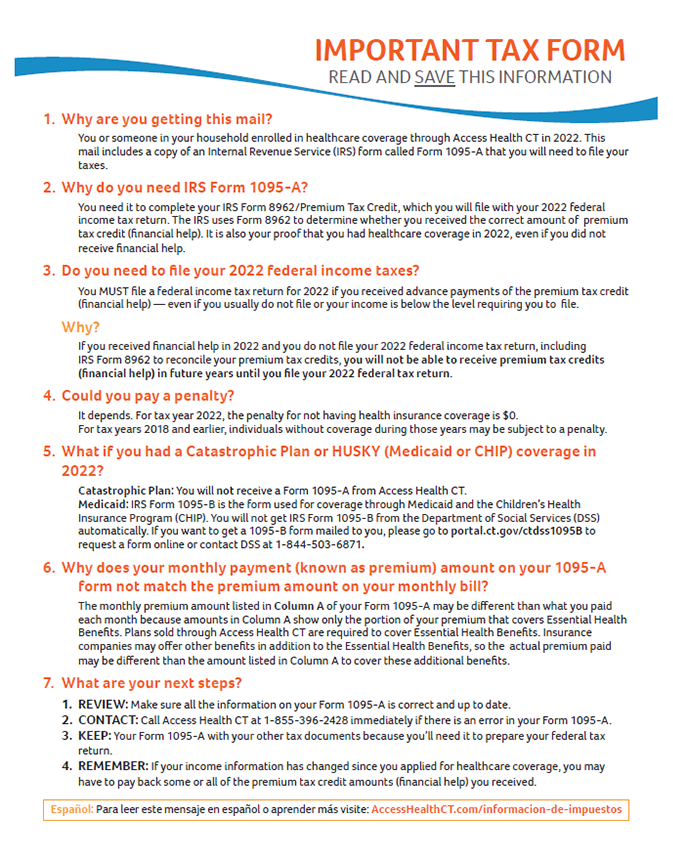

Tax Information for Your Health Coverage - Access Health CT

Cash App Taxes Review & Walkthrough 2023

1099-K Form Details - What Is Form 1099-K?

Cash App Taxes Review 2023, Can This Tax Prep Software Be Trusted?

How to Deduct Your Cell Phone Bill on Your Taxes

Zelle and Taxes: Will I Receive a 1099-K? - Optima Tax Relief

Cash App Taxes Review: How It Works & Is It Worth It?

Recomendado para você

-

Roblox 1000 robux gamepass method tax NOT covered15 novembro 2024

Roblox 1000 robux gamepass method tax NOT covered15 novembro 2024 -

50% OFF TAX! Roblox Gamepass - Rolimon's15 novembro 2024

-

TAX GFX - Roblox15 novembro 2024

-

Kool on X: 🎉 Logo Commissions 🎉 💵 Accepting robux through group funds or gamepass(gamepass will have 30% tax) 💵 💬 DM me on discord (koolkat339#9633) or twitter to order 💬 Likes15 novembro 2024

Kool on X: 🎉 Logo Commissions 🎉 💵 Accepting robux through group funds or gamepass(gamepass will have 30% tax) 💵 💬 DM me on discord (koolkat339#9633) or twitter to order 💬 Likes15 novembro 2024 -

10,000 Robux No Tax Covered15 novembro 2024

10,000 Robux No Tax Covered15 novembro 2024 -

Tax System (Roblox Studio)15 novembro 2024

Tax System (Roblox Studio)15 novembro 2024 -

ROBLOX: 1000 ROBUX R$ (TAX COVERED) QUICK DELIVERY15 novembro 2024

ROBLOX: 1000 ROBUX R$ (TAX COVERED) QUICK DELIVERY15 novembro 2024 -

The Best Deals on Tax-Filing Services: There's Still Time to File and Save15 novembro 2024

The Best Deals on Tax-Filing Services: There's Still Time to File and Save15 novembro 2024 -

FaraonArts™️ (Commissions CLOSED) on X: 🚨FaraonArts PFP Comissions OPEN!🚨 💵Advance Payments 🔵Paypal or ⚪️Robux Gamepass (Tax already included) 🌟Have your own PFP in 24 HOURS! 🔥Dm me in Twitter if interested!🔥 #roblox #15 novembro 2024

-

90% Marketplace Fee for groups on Configure Game Pass page - Website Bugs - Developer Forum15 novembro 2024

90% Marketplace Fee for groups on Configure Game Pass page - Website Bugs - Developer Forum15 novembro 2024

você pode gostar

-

CapCut_bugs do servidor avançado ff15 novembro 2024

-

Beekeepers Confront the E.P.A. Over Pesticides - The New York Times15 novembro 2024

Beekeepers Confront the E.P.A. Over Pesticides - The New York Times15 novembro 2024 -

Little lemmings are monitored from space15 novembro 2024

Little lemmings are monitored from space15 novembro 2024 -

Download do APK de Jogo para Casais - Erótico para Android15 novembro 2024

Download do APK de Jogo para Casais - Erótico para Android15 novembro 2024 -

Knockout City - Training15 novembro 2024

Knockout City - Training15 novembro 2024 -

Mighty The Armadillo 2023 Art Render (Archie Alt) by CalebArtboy15 on DeviantArt15 novembro 2024

Mighty The Armadillo 2023 Art Render (Archie Alt) by CalebArtboy15 on DeviantArt15 novembro 2024 -

Gif-vif : Daily Dose of GIFs15 novembro 2024

Gif-vif : Daily Dose of GIFs15 novembro 2024 -

Pinky Reborn 50cm Reborn Baby Doll 20inch Newborn Toddler Real Soft Touch Ma with Hand-Drawing Hair Handmade Doll : Toys & Games15 novembro 2024

Pinky Reborn 50cm Reborn Baby Doll 20inch Newborn Toddler Real Soft Touch Ma with Hand-Drawing Hair Handmade Doll : Toys & Games15 novembro 2024 -

night adventure download apk android|TikTok Search15 novembro 2024

night adventure download apk android|TikTok Search15 novembro 2024 -

How to get to Lady's Walk in Fife by Bus or Train?15 novembro 2024

How to get to Lady's Walk in Fife by Bus or Train?15 novembro 2024