2017 Tax Law Is Fundamentally Flawed

Por um escritor misterioso

Last updated 16 novembro 2024

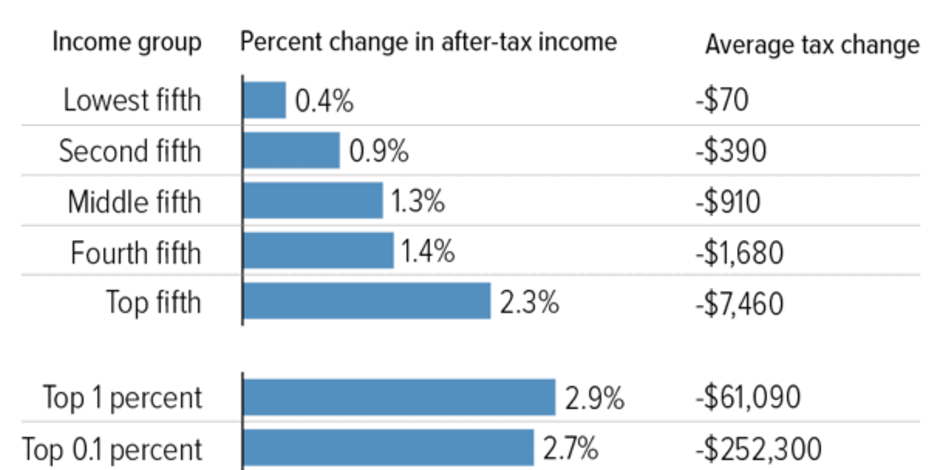

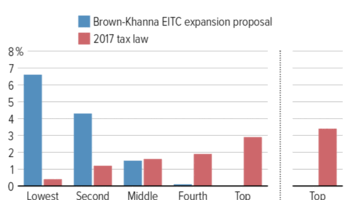

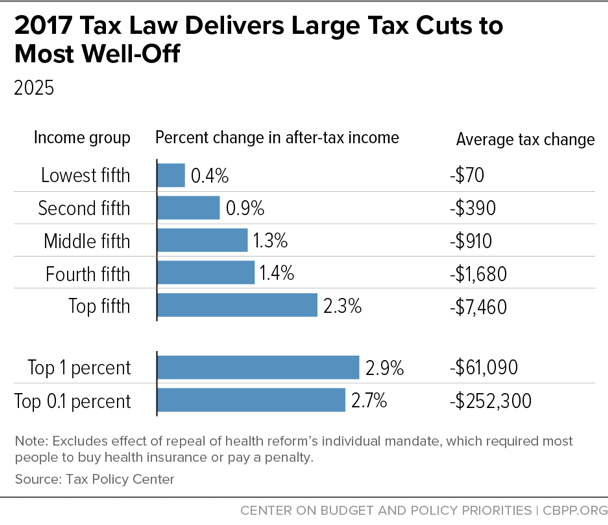

The major tax legislation enacted in December 2017 will cost about $1.9 trillion over ten years and deliver windfall gains to wealthy households and profitable corporations, further widening the gap

The Next Supreme Court Danger: Trashing One-Third of the Tax Code

The Trump tax law has big problems. Here's one big reason why

Tax Reform Briefs: 2017 Tax Law is Fundamentally Flawed

Local Tax Limitations Can Hamper Fiscal Stability of Cities and

TPC: Impacts of 2017 Tax Law's SALT Cap and Its Repeal

The fatal flaw of neoliberalism: it's bad economics

2017 Tax Law Is Fundamentally Flawed

The TCJA 2 Years Later: Corporations, Not Workers, Are the Big

Yet) Another Reason ISL Theory is Wrong About the Meaning of the

Types of Taxes – Income, Property, Goods, Services, Federal, State

Justices Seem Skeptical of Challenge to Trump-Era Tax Provision

Recomendado para você

-

Urban Dictionary Store16 novembro 2024

Urban Dictionary Store16 novembro 2024 -

Steam Workshop::Zeh's Library of Dice16 novembro 2024

-

none?e=16 novembro 2024

-

Qwertyuiopasdfghjklzxcvbnmmnbvcxzlkjhgfdsapoiuytrewqqazwsxed - 9GAG16 novembro 2024

Qwertyuiopasdfghjklzxcvbnmmnbvcxzlkjhgfdsapoiuytrewqqazwsxed - 9GAG16 novembro 2024 -

Faster than light : r/trolllogic16 novembro 2024

Faster than light : r/trolllogic16 novembro 2024 -

Problem?16 novembro 2024

Problem?16 novembro 2024 -

Hgfch, Potatoes Wiki16 novembro 2024

Hgfch, Potatoes Wiki16 novembro 2024 -

30+ Kate White profiles16 novembro 2024

-

pnqZayySy2ogm16 novembro 2024

pnqZayySy2ogm16 novembro 2024 -

April, 201016 novembro 2024

April, 201016 novembro 2024

você pode gostar

-

Desenho Uchiha óbito °Desenhistas Do Amino° Amino16 novembro 2024

Desenho Uchiha óbito °Desenhistas Do Amino° Amino16 novembro 2024 -

Saquê Seco Chef para Uso Culinário 5 litros Azuma - Loja Ikebana16 novembro 2024

Saquê Seco Chef para Uso Culinário 5 litros Azuma - Loja Ikebana16 novembro 2024 -

Shop Portable Game Boy Super Mario Gaming Funny Games 400 In 116 novembro 2024

Shop Portable Game Boy Super Mario Gaming Funny Games 400 In 116 novembro 2024 -

Breaking Up Online Daters: A Sad Roblox Movie16 novembro 2024

Breaking Up Online Daters: A Sad Roblox Movie16 novembro 2024 -

0.1% accuracy was the difference after 82 moves. : r/chess16 novembro 2024

0.1% accuracy was the difference after 82 moves. : r/chess16 novembro 2024 -

Episódio 13 do período azul: data de lançamento e discussões16 novembro 2024

Episódio 13 do período azul: data de lançamento e discussões16 novembro 2024 -

Anyone have a good app/software for editing meme on phone or16 novembro 2024

Anyone have a good app/software for editing meme on phone or16 novembro 2024 -

Anunciado filme e série live-action de Horimiya16 novembro 2024

Anunciado filme e série live-action de Horimiya16 novembro 2024 -

Pedro Horacio on Behance16 novembro 2024

Pedro Horacio on Behance16 novembro 2024 -

Efeito online da maquiagem virtual para ficar mais bonita - Fotoefeitos16 novembro 2024

Efeito online da maquiagem virtual para ficar mais bonita - Fotoefeitos16 novembro 2024